how to answer are you exempt from federal withholding

To claim exemption employees must. Your employees can claim exempt on their Federal Form W-4 or state form if they meet certain requirements.

How To Fill Out Irs Form W 4 Exempt Youtube

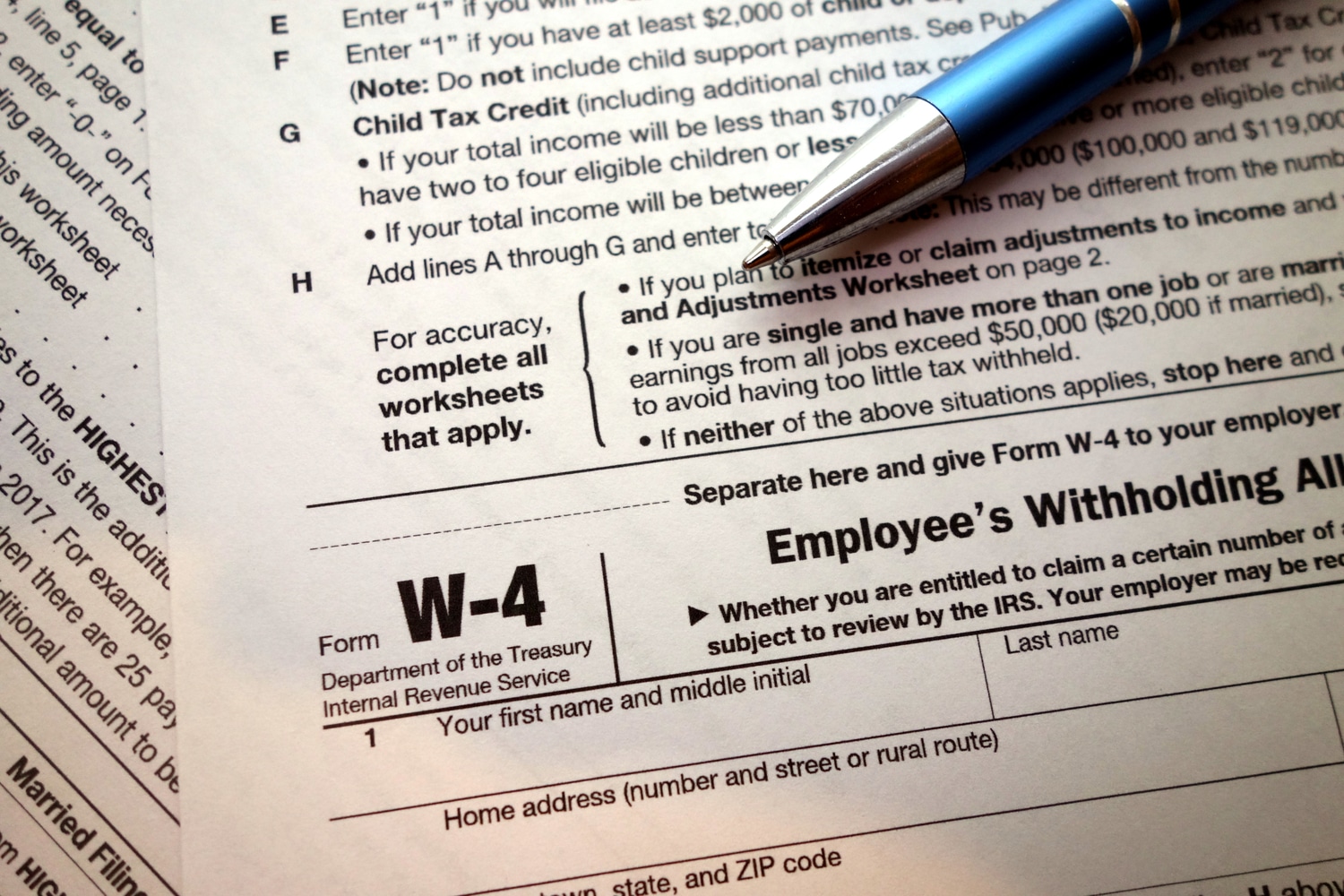

Leave the rest of the W-4 blank.

. An estimate of your income for the current year. Your company will deduct less from your salary if you claim fewer allowances. Investment type income such as taxable interest ordinary dividends and capital gain distributions.

2019 Prior Form W-4 Employees Withholding Allowance Certificate. On the line for Federal enter 99 and then save the record. On your W-4 enter your identifying information such as your name address and Social Security number.

How to answer are you exempt from federal withholding Wednesday June 8 2022 Edit. You may then owe tax and face a penalty when you file your return. Even if you qualify for a federal tax exemption your employer will still withhold Social Security and Medicare taxes.

If you want to claim exemption from withholding you need to fill out a new Form W-4 and submit it to your employer. 2018 Tax Law Changes. Sign and date the form and return it to your employer.

Per the IRS for 2022 every single filer will get a standard deduction of 12950. What this means is that if your income is below 12950 for the year most likely you will not have to pay any taxes. If your income can be canceled out by allowable tax deductions leaving you with no tax liability you can elect to be exempt from federal withholding said Ben Watson a certified public.

Should I claim exemption from withholding. If you claim EXEMPT you must complete a new W-4 annually in February. The steps to this article can be found on KB 10699.

If you can be claimed as a dependent on someone elses tax return you will need an estimate of your wages for this year and the total amount of unearned income. And thanks for choosing Sage. Write Exempt in the space below Step 4 c Complete Steps 1 a 1 b and 5.

You can claim up to three allowances on the W-4 form. On the form youll enter your personal information including your name address and Social Security number. If you see a W-4 with the word Exempt you know not to withhold federal income tax from that employees wages.

Keep the form in your records. To make an employee exempt from Federal taxes go to Maintain Employees and Sales Reps. Every time you fill out a W-4 you might be wondering Am I exempt from federal withholding To claim exemption you must meet a set of criteria.

If your employee claims exempt you should have a copy of the W-4 or state form for your records. If you meet the criteria for filing as exempt you should file exempt on your W-4. Sign and date Form W-4.

If you do this your employer wont withhold. Filing as exempt is not illegal. So if you feel your income will be less then 12950 for the whole year you can click this button.

In the past as an employer I was required to submit all Forms W-4 that claimed complete exemption from withholding when 200 or more in weekly wages were regularly expected or claimed more than 10 allowances. Choose the Employee ID and go to the Withholding Info tab. You may claim EXEMPT from withholding if.

Do not complete lines 5 and 6 and write Exempt in the box on line 7. The form isnt valid until you sign it. This form is completed by the employer and instructs them on how much to deduct from each paycheck.

O Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. In some cases you may be able to claim to be exempt from federal withholding. Heres how to set the Federal or State.

Remember you only have to fill out the new Form W-4 if you either start a. W 4 Form How To Fill It Out In 2022. Your employer will stop withholding federal tax after receiving your completed Form W-4.

Am I Exempt From Federal Withholding Do I Still Get A Refund Gobankingrates W 4 Form How To Fill It Out In. As of 2018 the standard deduction on federal income taxes is rising to 12000 for single people 18000 for people filing as head of household and 24000 for married. Each pay period your employer withholds money from your paycheck and sends it as a tax payment to the Internal Revenue Service on your behalf.

You can tell your boss how much money to withhold by filling out a W-4 form. Exempt means they wont have any Federal or State Withholding taxes deducted from their paychecks. To file a complete exemption write exempt in the space below Step 4 c on the W-4 form.

Youll also need to indicate your filing status and whether you have any dependents. To claim exempt write EXEMPT under line 4c.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Irs Name Change Letter Sample Letter To Irs Free Printable Documents Address The Recipient By Name And State Letter Sample Name Change Business Template

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Exempt From Backup Withholding What Is Backup Withholding Tax Community Tax

Exempt From Backup Withholding What Is Backup Withholding Tax Community Tax

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

How Do I Know If I Am Exempt From Federal Withholding

Am I Exempt From Federal Withholding Do I Still Get A Refund Gobankingrates

Preparer Training Tax Services Directions Truth

Do I Pay Taxes On Workers Comp Larry Pitt

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Am I Exempt From Federal Withholding H R Block

What Assets May Or May Not Be Exempt From The Tax On Capital Assets In Your Wealth Statement 2022

A Beautiful Infographic To Share The Similarities And Differences Of Banks And Credit Unions Infographic Credit Union Credit Repair Services Credit Repair

How Long Can You Claim Exemption Without Owing Taxes Quora

Exempt From Backup Withholding What Is Backup Withholding Tax Community Tax