nebraska transfer tax calculator

This marginal tax rate means that. The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as well as the nuances of your financial circumstances.

Vehicle And Boat Registration Renewal Nebraska Dmv

For example in Michigan state transfer taxes are levied at a rate of 375 for every 500 which translates to an effective tax rate of 075 375 500 075.

. Each state has its own tax rates and criteria. 9 Tax credit projects located in a rural area as defined in section 520 of the Housing Act of 1949. Phone numbers for the Sales Tax division of the Department of Revenue Services are as follows.

Refund Transfer is an optional tax refund-related product provided by MetaBank NA Member FDIC. Refund Transfer is a bank deposit product not a loan. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc.

Common examples include gains from the sale of stocks mutual funds and real estate. You can learn more by visiting the sales tax information website at wwwctgov. Tax questions tax.

Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a tax that varies by income level reaching rates as high as 133 in California. Dashboard My Taxes My Info My Preferences Tax Calculator Sign Out Sign In TaxAct Basic. Tax calculator tax calculator.

The Rent Income Limit Calculator has been updated for the FY 2022 HUD Income Limits and is being released in Beta form. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. Long-term capital gains are capital gains realized from the sale or transfer of a capital asset that has been held for at least a year and a day.

Your average tax rate is 1198 and your marginal tax rate is 22. Download TaxAct 2021 Basic Edition to file taxes easily and accurately and get your maximum tax refund. Refund Transfer is an optional tax refund-related product provided by MetaBank NA Member FDIC.

You can file. For instance the inheritance tax rate is as much as 18 in Nebraska so a beneficiary might owe the government 18000 if they inherited a 100000 account. For Simple Federal Returns Fast and easy tax filing for simple returns 39 95 State Additional Benefits Forms.

860 297-5962 Toll-Free Phone. The Rent Income Limit Calculator is still being tested for potential errors or calculation issues. Average DMV fees in Nebraska on a new-car purchase add up to 67 1 which includes the title registration and plate fees shown above.

Estimate your tax refund with HR Blocks free income tax calculator. Tax prep checklist tax prep checklist. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

Note that transfer tax rates are often described in terms of the amount of tax charged per 500. The Connecticut Sales Tax is administered by the Connecticut Department of Revenue Services. But theres a bit of good news herethe more closely related to the decedent someone is the less of a tax rate theyll pay.

Please note you may need. Assessed value is often lower than market value so effective tax rates taxes paid as a percentage of market value in California are typically lower than 1 even though nominal tax rates. The table below shows effective property tax rates as well as median annual property tax payments and median home values for each county in California.

If you make 70000 a year living in the region of California USA you will be taxed 15111. Fore more information about Nebraska refunds and tax information visit the following website. These fees are separate from.

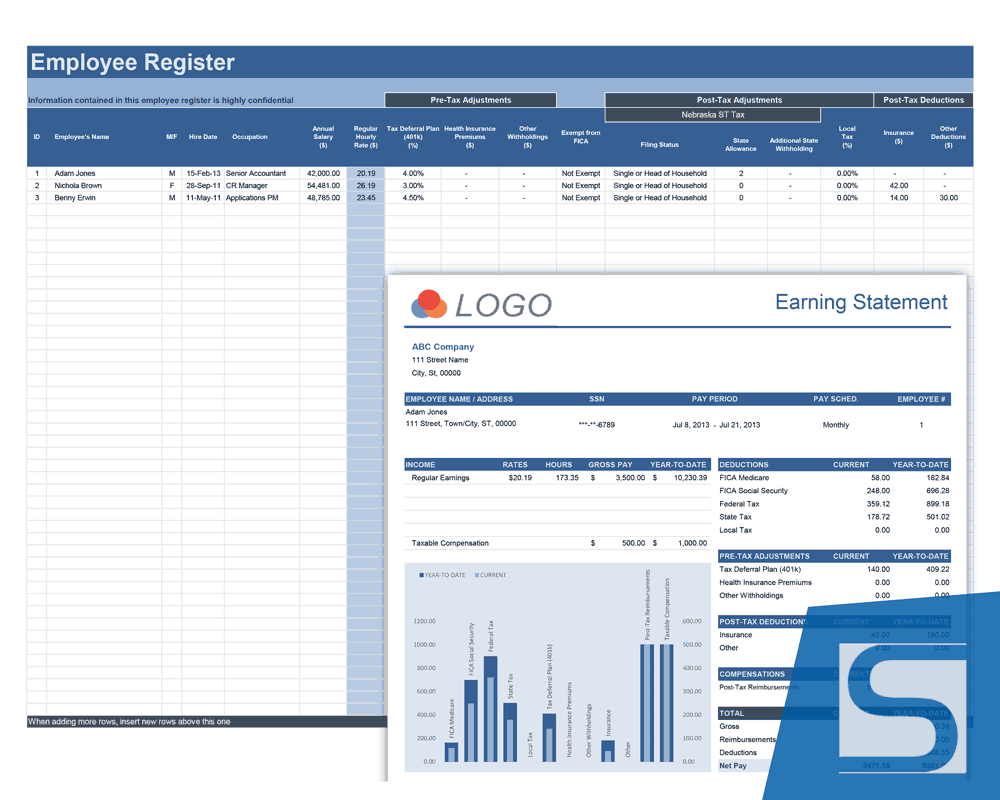

Refund Transfer is a bank deposit product not a loan. Then you can use the IRS withholding calculator to understand what tax rate to apply for each employee. Nebraska Documentation Fees.

You only have to answer the survey once to unlock the tax calculator for 24 hours.

Dmv Fees By State Usa Manual Car Registration Calculator

Sales Tax On Cars And Vehicles In Nebraska

What Are Real Estate Transfer Taxes Forbes Advisor

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Nebraska Real Estate Transfer Taxes An In Depth Guide

Nebraska Property Tax Calculator Smartasset

Income Tax Calculator 2021 2022 Estimate Return Refund

What You Should Know About Contra Costa County Transfer Tax

Sales Tax By State Is Saas Taxable Taxjar

Property Tax Calculator Casaplorer

Transfer Tax Alameda County California Who Pays What

Nebraska Property Tax Calculator Smartasset

Inheritance Tax 2022 Casaplorer

A Breakdown Of Transfer Tax In Real Estate Upnest

Transfer Tax In San Luis Obispo County California Who Pays What

Transfer Tax In Marin County California Who Pays What